Carbon Markets, Illustrated

A brief guide to one of the climate solutions we need in order to achieve a low-carbon future faster.

Climate change is an unprecedented global emergency. We must use all the tools at our disposal to ensure a positive future for people and nature. This includes a massive investment in decarbonization—as well unlocking the power of nature through Natural Climate Solutions. High-quality carbon markets are one strategy that can effectively reduce harmful emissions and equitably benefit communities.

But even though carbon markets could create much-needed incentives for faster climate action, they are often misunderstood.

How can carbon markets help solve the climate crisis?

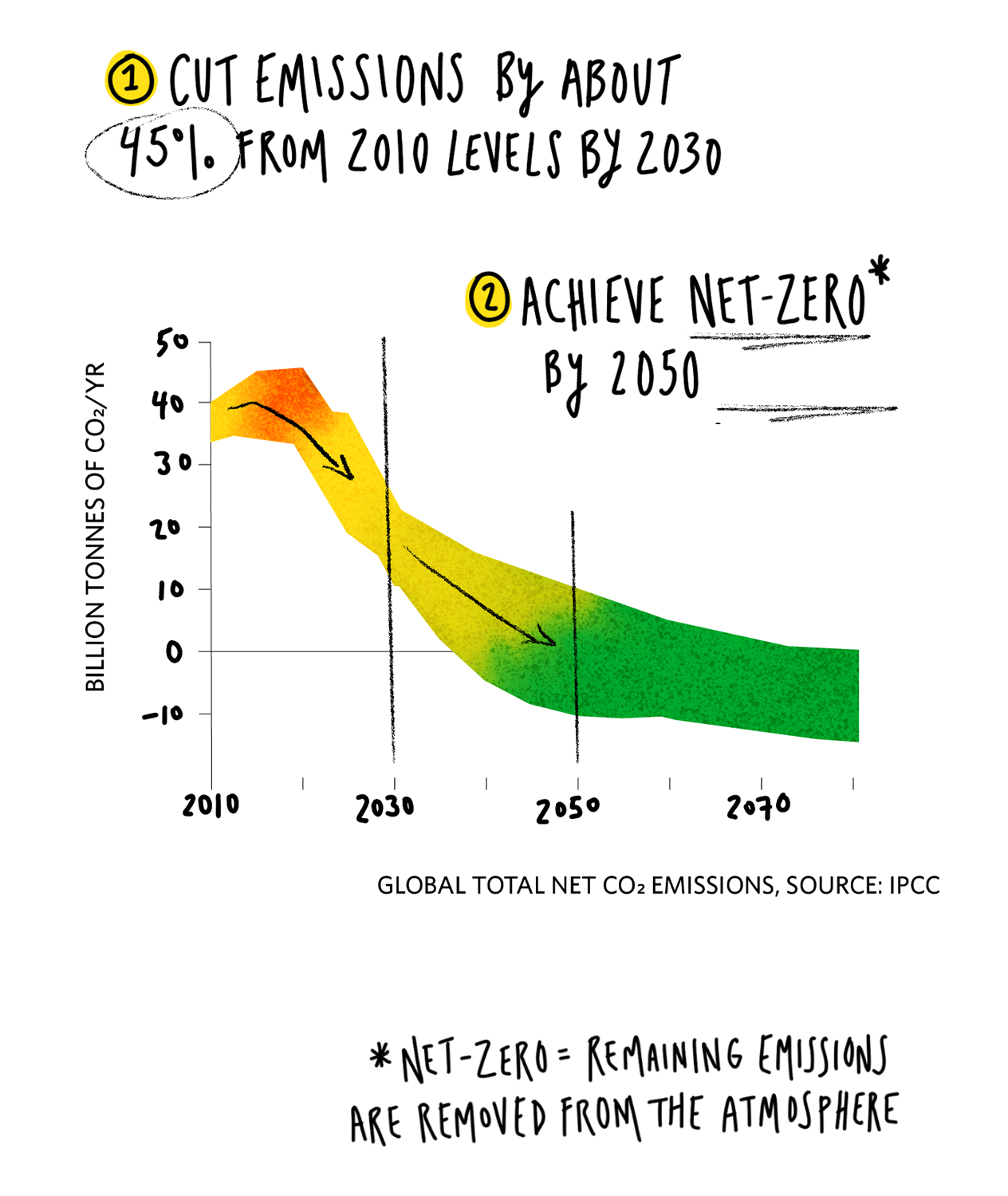

The Intergovernmental Panel on Climate Change (IPCC) has identified two major climate mitigation imperatives to keep global temperatures within a safer range:

Reducing greenhouse gas (GHG) emissions will be easier for some governments and companies than others. Consider that technological advances have improved the efficiency of the cars we drive faster than the planes we fly, for example.

Subscribe for More Insights

This article (now updated for 2025) was originally the first in a two-part series on technology and innovation that ran in the March 2021 issue of the Global Insights newsletter. Subscribe here to get part two and other exclusive insights like these straight to your inbox.

What is a Carbon Credit?

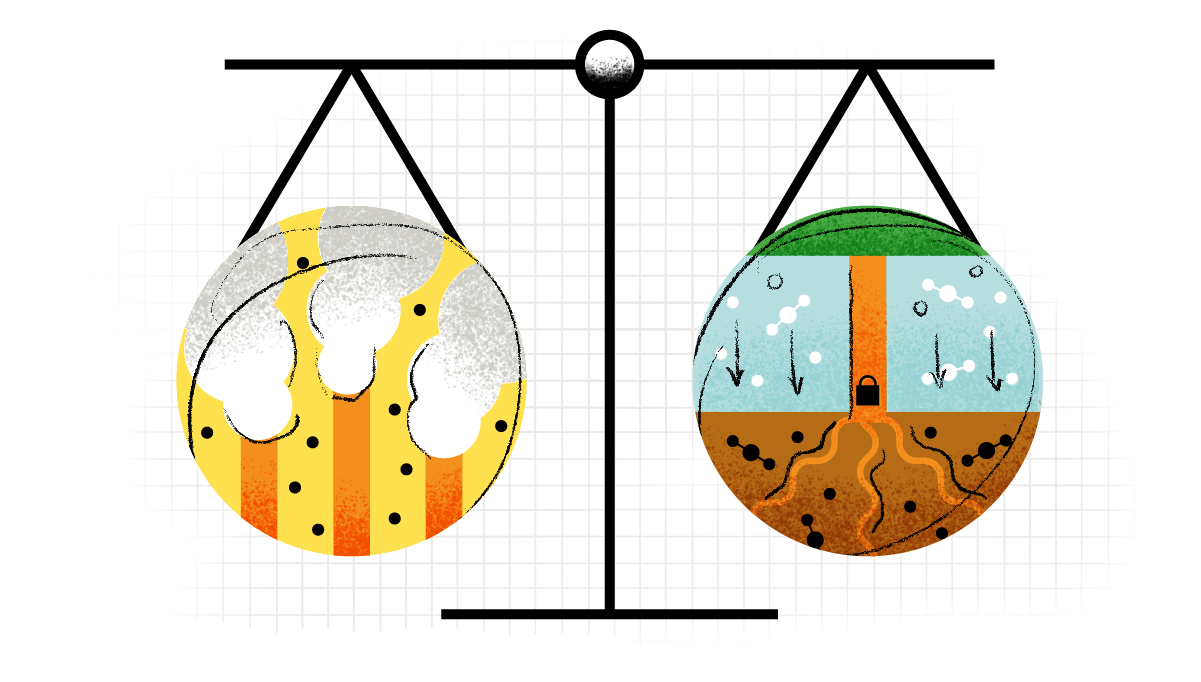

A carbon credit represents one tonne of carbon dioxide or equivalent greenhouse gases that have been reduced, avoided, or removed by a mitigation activity. Carbon credits are issued to project developers after they have met stringent rules set out by governments or an independent certification body and after being verified by a third-party auditor.

How do carbon markets help address emissions?

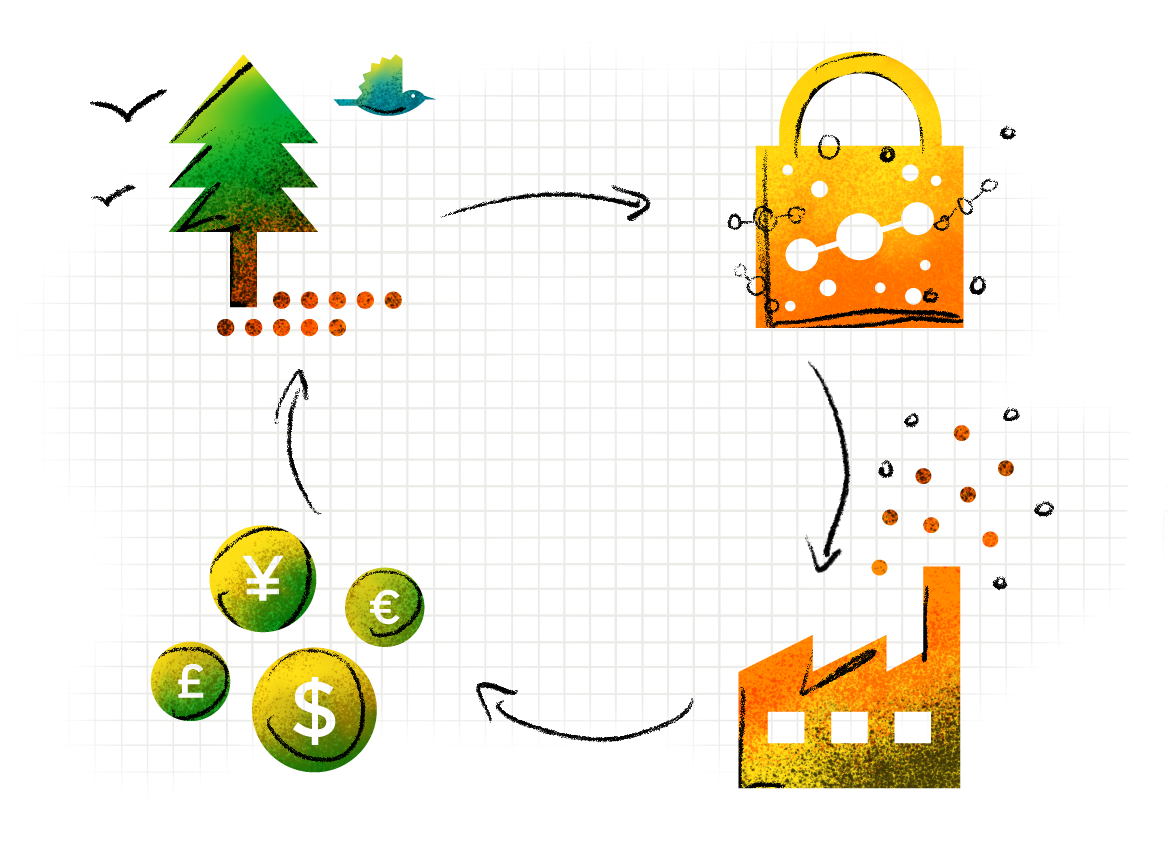

The practice of carbon credit trading is simple enough in theory. By leveraging carbon markets, countries and companies find opportunities to mitigate the GHG emissions they struggle to reduce or remove, while resources can be channeled directly to carbon projects and the communities that lead them.

You’re probably familiar with the sources of emissions, but what about these solutions that reduce, remove and store them?

Projects or large-scale policy programs to stop deforestation, restore degraded soils or protect mangroves and grasslands can either reduce emissions from nature or increase nature’s ability to store more emissions.

Through carbon markets, such projects can sell the resulting carbon credits to emitters or countries who wish to contribute to global mitigation. Carbon markets can either be built for voluntary participation (think: companies voluntarily financing additional mitigation), compliance with legal frameworks, or countries with ambitious decarbonization goals under the Paris Agreement.

Do carbon credits give companies permission to pollute?

Carbon credits should not be the only way a company addresses its climate impact. Credits should be part of a comprehensive strategy, including measuring emissions, setting an ambitious emissions reduction target and reducing their own emissions directly.

However, this transition will take time—time we don’t have to stop the climate crisis. Carbon credits, when used in combination with other tools, can finance much-needed emissions reductions, especially in the short term, speeding the transition to a net-zero world.

What makes a carbon credit “high-quality”?

To be effective, only high-integrity credits should reach the market.

Carbon market standards are developed through an open process of public consultation, transparency, and independent third-party assessment. High-quality carbon markets must address:

- Additionality: A carbon credit is “additional” if it represents emission reductions that are above and beyond what would have been achieved under a “business as usual” scenario and would not have occurred in the absence of the carbon market project.

- Durability: Emissions need to be removed or reduced for a meaningful amount of time in order to have impact for climate.

- No Leakage: When a project stops carbon-emitting activities—such as deforestation—in one area, the carbon-emitting activities should not simply shift to another area.

- Safeguards: There must be strong safeguards to protect biodiversity and to ensure that Indigenous Peoples, local and traditional communities who are stewards of nature fully and freely participate in and benefit from the project.

This is just a starting point. TNC’s Global Carbon Market Team oversees engagement and has developed a set of standards for high-quality carbon offset projects based around three principles: robust carbon accounting, maximizing returns and benefits for communities and nature, and the responsible use of carbon credits.

The Climate Ambition Gap

A new vision for carbon markets to help the world reach critical climate targets.

Read moreHow have carbon markets changed?

Carbon markets—like any other new tool or technology—have continuously improved over time.

Today, more regulation and guidance is being developed for both buyers and sellers of carbon credits. Progress continues to be made to ensure transparency and high integrity in global carbon markets.

TNC has more than 20 years of experience pioneering best practices for Natural Climate Solutions and carbon projects around the world. We are committed to supporting high-quality carbon credits that fight climate change, conserve natural ecosystems, and provide equitable benefits to Indigenous Peoples, local, and traditional communities.

Scaling up carbon markets faster—and getting them right—will be essential to reducing emissions in the near term, distributing capital to the communities that lead on climate mitigation, and funding the low-carbon future we need.

Still curious about carbon markets? Watch this short video.

Global Insights

Check out our latest thinking and real-world solutions to some of the most complex challenges facing people and the planet today.